ITR filing deadline for As.Y 2025-26 is extended by CBDT, announced by CBDT. Learn key changes in ITRs for AY 2025-26, how to file, FAQs, and a deep analysis of its impact on taxpayers.

Introduction: A Welcome Relief for Taxpayers

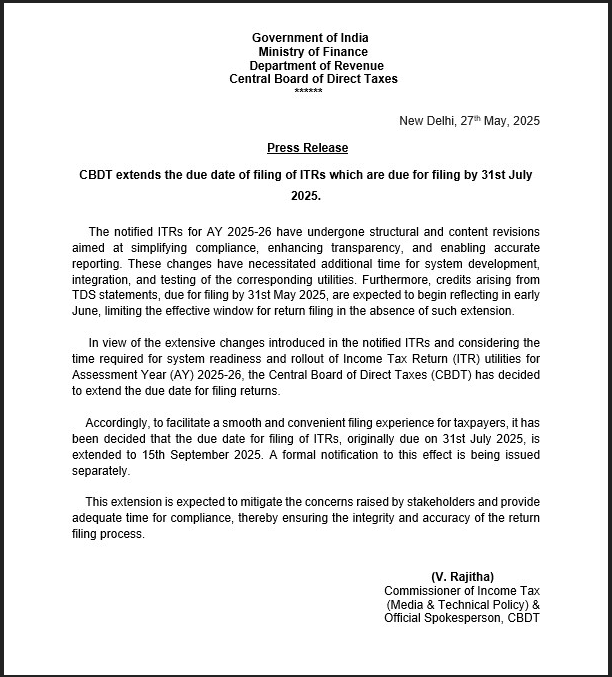

The Central Board of Direct Taxes (CBDT) has recently brought a sigh of relief to millions of taxpayers in India. On May 27, 2025, the CBDT announced an extension of the due date for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025-26. Originally set for July 31, 2025, the deadline has now been extended to September 15, 2025. This decision comes in response to significant changes introduced in the ITR forms for AY 2025-26, aimed at simplifying compliance, enhancing transparency, and ensuring accurate reporting.

For taxpayers, this extension provides much-needed breathing room to navigate the updated ITR forms and comply with the new requirements. In this article, we’ll dive deep into the reasons behind this extension, the changes in ITR forms, how taxpayers can make the most of this additional time, and what it means for the future of tax filing in India. We’ll also address frequently asked questions (FAQs) and provide a detailed analysis of the implications of this decision.

Why Was the ITR Filing Deadline Extended in 2025?

The CBDT’s press release, issued on May 27, 2025, highlights the primary reason for extending the ITR filing deadline: the extensive structural and content revisions in the ITR forms for AY 2025-26. These changes are part of the government’s broader goal to streamline tax compliance, make the process more transparent, and ensure accurate reporting of income. However, such significant updates require additional time for system development, integration, and testing of the corresponding utilities.

The press release notes that the revised ITR forms were notified by May 31, 2025. However, the effective filing window for taxpayers was limited due to the time required to roll out the updated Income Tax Return (ITR) utilities. Recognizing these challenges, the CBDT decided to extend the deadline to September 15, 2025, giving taxpayers an additional 46 days to file their returns.

The extension aims to achieve two key objectives:

- Facilitate a Smooth Filing Experience: By providing extra time, the CBDT ensures that taxpayers can file their returns without facing technical glitches or errors in the new system.

- Mitigate Stakeholder Concerns: The extension addresses concerns raised by taxpayers, tax professionals, and other stakeholders about the complexity of the new ITR forms and the need for adequate time to comply.

Key Changes in ITR Forms for AY 2025-26

The ITR forms for AY 2025-26 have undergone significant revisions to align with the government’s vision of simplifying tax compliance. While the exact details of the changes are not specified in the press release, we can infer some likely updates based on past trends and the stated goals of transparency and accuracy. Here are some potential changes that taxpayers might encounter:

- Simplified Reporting Structure: The new ITR forms may include a more user-friendly format, with clearer sections for reporting income, deductions, and exemptions. This could involve consolidating multiple schedules into a single section to reduce confusion.

- Enhanced Transparency查询 in Financial Transactions: To curb tax evasion, the revised forms might require more detailed disclosures of financial transactions, such as high-value expenditures, foreign assets, or cryptocurrency investments.

- Integration of Pre-Filled Data: The Income Tax Department has been increasingly using pre-filled ITR forms to simplify the filing process. For AY 2025-26, the pre-filled data might include more comprehensive details, such as interest income, dividend income, and capital gains, sourced directly from banks, employers, and other financial institutions.

- Focus on TDS Compliance: With credits arising from Tax Deducted at Source (TDS) being a key component of tax returns, the new forms may introduce stricter validation mechanisms to ensure that TDS claims match the data reported in Form 26AS.

- Support for New Tax Regimes: The ITR forms may provide better support for taxpayers opting for the new tax regime introduced in 2020, which offers lower tax rates in exchange for forgoing certain deductions and exemptions.

These changes, while beneficial in the long run, require taxpayers to adapt to new reporting requirements. The extended deadline gives them the opportunity to understand these updates, gather the necessary documents, and file their returns accurately.

How to Make the Most of the Extended Deadline

The extension of the ITR filing deadline to September 15, 2025, is a golden opportunity for taxpayers to ensure compliance without the last-minute rush. Here are some practical tips to make the most of this additional time:

- Understand the New ITR Forms: Start by reviewing the updated ITR forms for AY 2025-26, which are available on the Income Tax Department’s e-filing portal. Pay close attention to the new sections and requirements to avoid errors during filing.

- Gather All Necessary Documents: Use this time to collect all relevant documents, such as Form 16 (for salaried individuals), bank statements, investment proofs, and details of any other income sources. If you have foreign assets or income, ensure you have the necessary documentation ready.

- Verify Pre-Filled Data: If you’re using a pre-filled ITR form, cross-check the data with your records. Discrepancies in pre-filled data, such as missing interest income or incorrect TDS credits, can lead to errors in your return.

- Consult a Tax Professional: If the new ITR forms seem complex, consider seeking help from a tax professional or chartered accountant. They can guide you through the updated requirements and ensure that your return is filed correctly.

- File Early to Avoid Penalties: While the deadline has been extended, it’s always a good idea to file your ITR as early as possible. Filing late, even within the extended deadline, may result in a late filing fee under Section 234F of the Income Tax Act, which can be up to ₹5,000 for most taxpayers.

- Double-Check for Accuracy: The CBDT has emphasized the importance of accuracy in return filing. Use the extra time to review your ITR thoroughly, ensuring that all income, deductions, and exemptions are reported correctly.

By following these steps, taxpayers can avoid common pitfalls and ensure a hassle-free filing experience.

Deep Analysis: Implications of the Extended Deadline

The extension of the ITR filing deadline for AY 2025-26 has far-reaching implications for taxpayers, tax professionals, and the government. Let’s analyze its impact in detail:

Impact on Taxpayers

The extended deadline is a boon for taxpayers, particularly those who struggle with last-minute filing. It provides additional time to understand the new ITR forms, gather documents, and seek professional help if needed. This is especially beneficial for individuals with complex financial portfolios, such as business owners, professionals, and those with foreign income or assets.

However, the extension may also lead to procrastination among some taxpayers. Those who delay filing until the last moment may still face challenges, such as server overload on the e-filing portal or errors in their returns due to rushed preparation. To avoid such issues, taxpayers should aim to file well before the September 15, 2025, deadline.

Impact on Tax Professionals

For tax professionals and chartered accountants, the extension provides much-needed relief during the peak filing season. The original deadline of July 31 often leads to a crunch, with professionals handling a large volume of returns in a short period. The extended deadline gives them more time to assist their clients, ensuring better accuracy and compliance.

However, the extension may also increase expectations from clients, who may assume that the additional time means they can delay providing their documents. Tax professionals will need to communicate clearly with their clients, emphasizing the importance of timely submission of information to avoid last-minute stress.

Impact on the Government

For the government, the extension reflects a commitment to improving the tax filing process and addressing stakeholder concerns. By providing extra time, the CBDT aims to reduce errors in returns, which can lead to fewer notices and disputes in the future. This aligns with the government’s goal of enhancing the integrity and accuracy of the return filing process, as stated in the press release.

However, the extension may delay the government’s revenue collection process, as tax payments are typically made at the time of filing. This could have a temporary impact on cash flow, particularly for advance tax payments that are adjusted during ITR filing. To mitigate this, the government may need to encourage early filing through awareness campaigns and incentives.

Long-Term Implications

The extension of the ITR filing deadline for AY 2025-26 sets a precedent for future years. It signals that the government is willing to accommodate taxpayers when significant changes are introduced in the tax system. This could lead to more flexible deadlines in the future, especially as the Income Tax Department continues to digitize and modernize its processes.

Additionally, the focus on simplifying compliance and enhancing transparency through the new ITR forms is a step toward a more robust tax system. Over time, these changes are likely to reduce tax evasion, increase voluntary compliance, and improve the overall efficiency of tax administration in India.

Source : https://x.com/IncomeTaxIndia/status/1927323353251012645/photo/1

For More Details Contact US

Frequently Asked Questions (FAQs)

1. What is the new ITR filing deadline for AY 2025-26?

Ans :The new ITR filing deadline for the Assessment Year 2025-26 is September 15, 2025, extended from the original deadline of July 31, 2025.

2. Why was the ITR filing deadline extended in 2025?

Ans : The deadline was extended due to significant changes in the ITR forms for AY 2025-26, which required additional time for system development, integration, and testing of the filing utilities.

3. Will I be charged a late filing fee if I file by September 15, 2025?

Ans : No, you will not be charged a late filing fee if you file by the extended deadline of September 15, 2025. However, filing after this date may attract a late filing fee of up to ₹5,000.

4. How can I access the new ITR forms for AY 2025-26?

Ans : The new ITR forms are available on the Income Tax Department’s e-filing portal (www.incometax.gov.in). You can download the relevant form based on your income sources and category.

5. What happens if I miss the extended deadline?

Ans : If you miss the extended deadline of September 15, 2025, you can still file a belated return by December 31, 2025. However, you may have to pay a late filing fee and could lose certain tax benefits, such as carrying forward losses.

6. Are there any changes in the tax slabs for AY 2025-26?

Ans : The press release does not mention changes in tax slabs. Any updates to tax slabs or rates are typically announced during the Union Budget, so you should check the latest budget announcements for confirmation.

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/pt-BR/register-person?ref=GJY4VW8W

yohohoio has caught my eye! Been checking it out and it’s got some cool stuff going on. I’d recommend taking a look if you get the chance. Find them down below: yohohoio

Your article helped me a lot, is there any more related content? Thanks!

Logged on to 11vipphcasinologin. So far so good. Nice and fast. Easy login. Hopefully I win! Wish me luck!

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/it/register-person?ref=P9L9FQKY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/pt-PT/register-person?ref=KDN7HDOR

Yo, scope out t555game. Might find something legit. Always good to have different options t555game.

Yo, b9games has been keeping me entertained! Seriously, a lot of options to choose from. Check it out, might find your next addiction b9games.

777sxgameapk? That’s the spot! Got me hooked up. Give it a look-see 777sxgameapk

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?