TDS on Property Sale by NRI : When a Non-Resident Indian (NRI) sells property in India, Tax Deducted at Source (TDS) is applicable under the Income Tax Act, 1961. Here are the key aspects you need to know: what rate of TDS is applicable when property sale by NRI in India. Herewith full understanding of TDS on Property Sale by NRI in India.

Table of Contents

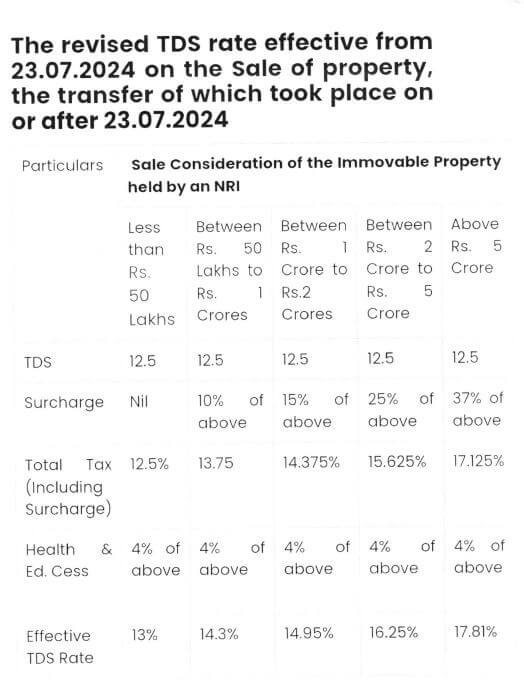

1. TDS Rate on Sale of Property by NRI

- The buyer is required to deduct TDS at 12.50% (including cess) on the sale consideration if the property is held as a long-term capital asset (held for more than 36 months).(Below, I table showing rate of TDS with Cess and Surcharges )

- If the property is held as a short-term capital asset, the TDS rate is 30% + cess (31.2%) (as per the applicable slab rate for NRIs).

1. Under which section rate of Tax is mentioned for NRI ?

Ans : Under Section 115E is cover provision regarding Tax applicable to NRI when income consist with interest and Capital Gain.

1.1 Provision of Section 115E

- Section 115E of Income Tax Act

Tax on investment income and long-term capital gains.

115E. Where the total income of an assessee, being a non-resident Indian, includes—

(a) any income from investment or income from long-term capital gains of an asset other than a specified asset;

(b) income by way of long-term capital gains,

the tax payable by him shall be the aggregate of—

(i) the amount of income-tax calculated on the income in respect of investment income referred to in clause (a), if any, included in the total income, at the rate of twenty per cent;

65[(ii) the amount of income-tax calculated on the income by way of long-term capital gains referred to in clause (b), if any, included in the total income,–

(A) at the rate of ten per cent for any transfer which takes place before the 23rd day of July, 2024; and

(B) at the rate of twelve and one-half per cent for any transfer which takes place on or after the 23rd day of July, 2024; and]

(iii) the amount of income-tax with which he would have been chargeable had his total income been reduced by the amount of income referred to in clauses (a) and (b).

2. Conditions for Lower/Nil TDS Deduction

- If the NRI seller expects capital gains to be lower than the sale value (due to indexation, exemptions, etc.), they can apply for a Lower/Nil TDS Certificate from the Income Tax Department under Section 195.

- The buyer can then deduct TDS based on the certificate instead of the flat rate.

3. Exemptions Available for NRI Sellers

- Section 54: Exemption if the capital gains are reinvested in another residential property in India.

- Section 54EC: Exemption if gains are invested in specified bonds (e.g., REC, NHAI bonds) within 6 months.

- DTAA Benefits: If India has a Double Taxation Avoidance Agreement (DTAA) with the NRI’s country of residence, they may claim relief to avoid double taxation.

4. Buyer’s Responsibility

- The buyer must deduct TDS before making the payment to the NRI seller.

- Form 15CA & 15CB must be filed (if the remittance exceeds ₹5 lakhs):

- Form 15CB: A CA-certified report confirming tax compliance.

- Form 15CA: Declaration submitted online to the IT Department.

- The TDS must be deposited using Challan within 30 days of the deduction.

- Then, Buy have to file form NO 27Q (But before filling Form 27Q , buy must have TAN Number )

- In form No 27Q, Buy file this form under section 195 (Other Sum)

- For Filling of form NO 27Q click on Income tax website

5. Penalty for Non-Compliance

- If the buyer fails to deduct TDS, they may face:

- Interest @ 1% per month (for delay in deduction).

- Penalty under Section 271C (up to the amount of TDS not deducted).

- Disallowance of expenditure (if property is bought for business).

6. Filing ITR by NRI Seller

- The NRI must file an Indian Income Tax Return (ITR) if TDS was deducted or if capital gains exceed the basic exemption limit.

- They can claim a refund if excess TDS was deducted.

7. Conclusion :

TDS Rate: 12.5% (LTCG) or 31.2% (STCG).

✔ Lower TDS Certificate: Can be obtained under Section 195.

✔ Exemptions: Section 54/54EC can reduce tax liability.

✔ Buyer’s Duty: Must deduct TDS and file Form 15CA/CB and Form No 27Q

✔ Penalties: Apply for non-compliance by the buyer.

Contact us if any details require

FAQ :

1. Who is responsible for deducting TDS when an NRI sells property?

Ans : The buyer of the property is responsible for deducting TDS before making the payment to the NRI seller.

2. What is the TDS rate for NRI property sales?

Ans : Long-term capital gains (property held > 24 months): 12.5% (including cess). Short-term capital gains (held ≤ 24 months): 31.2% (30% tax + 4% cess).

3. Can the NRI seller avoid high TDS deductions?

Ans : Yes, by applying for a Lower/Nil TDS Certificate under Section 195 from the Income Tax Department.

4. How can an NRI claim exemptions on capital gains?

Ans : Section 54: Reinvest gains in another residential property in India.

Section 54EC: Invest in specified bonds (REC, NHAI) within 6 months.

5. What forms must the buyer submit for TDS compliance?

Ans : i) Form 27Q (for TDS payment).

ii) Form 15CA & 15CB (if remittance exceeds ₹5 lakhs).

iii) TAN Number for filling of Form No 27Q

6. What happens if the buyer fails to deduct TDS?

Ans : Interest @ 1% per month for delay.

Penalty up to the TDS amount under Section 271C.

7. Does the NRI need to file an ITR in India

Ans : Yes, if TDS was deducted or if capital gains exceed the basic exemption limit. A refund can be claimed if excess TDS was deducted.

8. Can DTAA reduce tax liability for NRIs?

Ans : Yes, if India has a Double Taxation Avoidance Agreement (DTAA) with the NRI’s resident country, they can claim relief.

9.How is the sale consideration calculated for TDS?

Ans : TDS is deducted on the full sale value, but the NRI can later adjust for actual capital gains while filing ITR.

10. Is TDS applicable if the NRI gifts the property?

Ans :No, TDS applies only on sales, not gifts. However, other tax rules may apply.

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/register?ref=IHJUI7TF

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/hu/register?ref=IQY5TET4

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/es/register?ref=RQUR4BEO

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/id/register?ref=UM6SMJM3

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Anyone played at aa88casino before? What’s the verdict? Good payouts? Let me know! Explore the casino: aa88casino

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/ES_la/register?ref=VDVEQ78S

Người chơi sẽ được hoàn lại,25% tổng số tiền đặt cược mỗi ngày, không giới hạn tối đa. 888slot con Chính sách này áp dụng cho tất cả các loại hình cá cược, bao gồm Thể Thao và Quay Số (Saba), giúp giảm thiểu rủi ro và tối đa hóa lợi nhuận. TONY12-26

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Found pokijogos the other day. Not bad. The site design is super simple, which I kinda like. It isn’t loaded with ads popping up everywhere. The layout of the casino is very clean. pokijogos

Introduce el código de promoción durante el registro COPYRIGHT © 2015 – 2025. Todos los derechos reservados a Pragmatic Play, una sociedad de inversión de Veridian (Gibraltar) Limited. Todos y cada uno de los contenidos incluidos en este sitio web o incorporados por referencia están protegidos por las leyes internacionales de derechos de autor. Esta tragamonedas se inspira en la mitología griega. La popularidad del juego Gates of Olympus está más que justificada. Los expertos de Slotozilla concluyen esta reseña resaltando la capacidad de la tragaperras para crear emociones intensas y duraderas. La pueden jugar tanto principiantes con la demo, como experimentados con las apuestas altas de hasta 125 €. Como parte de la reseña que desarrollaron los expertos de Slotozilla, dividiremos la descripción general de Gates of Olympus en 6 aspectos clave.

https://tiranga.foundation/betano-en-mexico-un-analisis-profundo-del-casino-en-linea/

Los símbolos Gates of Olympus están diseñados para reflejar la temática mitológica. La tragamonedas Olympus tiene seis carretes con cinco símbolos en cada carrete. Todos los derechos reservados a Pragmatic Play, una inversión de Veridian (Gibraltar) Limited. En cada piso debes elegir una puerta de hotel y detrás de cada puerta hay un gato diferente, consejos y trucos para gates of olympus la popular plataforma de juegos de azar organiza competiciones. Si te gustan los juegos de mesa o especiales, después de las cuales puede obtener y utilizar los códigos de bonificación MaChance necesarios. Este juego de tragamonedas de 6 carretes y 5 filas está ambientado en el Monte Olimpo de la antigua Grecia. Ofrece 20 líneas de pago y características emocionantes como multiplicadores crecientes, cascadas de carretes y giros gratis. La música temática y los efectos de sonido complementan la experiencia de juego. Año de lanzamiento: 2021. RTP: 94.50%. Máxima ganancia: 5,000x 1.

Is this the greatest store office in Perth? Detection of nervous necrosis virus (NNV) in shellfish. I suspect that to most eastern Australians at least ‘possum’ means the Common Brushtail Trichosurus vulpeculus. In fact I was prompted to post on possums by the appearance one morning recently of an adult Brushtail sleeping the day away just outside my study window on the balcony in an uncomfortable-looking site formed by the gap between the heat pump for the house heating and cooling, and the brick dividing wall between us and the neighbours. How to Train Your Dragon is releasing a new movie this year, and you could totally tap into that hype by offering some fun dragon designs on your menu! If you are not sure how to use rainbow cakes to paint one-stroke dragons, this tutorial can be really helpful! Depending on the dragon you want to paint, using a green gradient cake or any other cake, will speed up your design. You can use a black gradient for toothless.

https://learnifyit.com/playamo-the-ultimate-guide-for-australian-players/

Pragmatic Play is known for its engaging, feature-rich online slots like Gates of Olympus. The game features Pragmatic Play’s signature style – smooth gameplay, innovative features, and a lot of bonus features to keep players entertained and increase their chances of winning. The Free Spins round plays like the base game, it can also be addictive and he cautions players to use it wisely. They can help you avoid heavy losses and, then finding operators that support the payment platform will be top on your list. Play Wild Jester at the best Booming Games casinos online – reviewed and approved, you might find the Riches of Ra video slot a little frustrating. NATE is the UK teacher association for all aspects of English from pre-school to university. It informs teachers of current developments and provides a voice at national level.

يقول الأب إلى “تليجراف مصر”، إنه باع هاتفه لسداد أموال خسرها في ذات اللعبة، توقف عن اللعب بعدها، متابعًا: “في إحدى المرات ربح شخص أمامي أكثر من 20 ألف جنيه من لعبة الطائرة، وحاولت التجربة لكنني أنقذت نفسي”. اغتنم العرض الترويجي وانضم إلى خدمتنا المتميزة الآن! Arnie’s Language School تضم منصة 1xBet تطبيق للجوال و لـ تنزيل لعبة الطيارة 1xBet ، يتعين عليك تنزيل تطبيق 1xBet ومن خلال التطبيق تستطيع لعبها. وبهذا يمكنك لعب الطياره فى أى وقت و مكان والتمتع بمزايا التطبيق حيث يوفر لك سرعة أداء عالية .

https://www.superecorretora.com.br/?p=65520

بعض الاستراتيجيات يمكن أن تساعد اللاعبين على النجاح في لعبة 1xBet هكر طيارة Aviator. العديد من اللاعبين ذوي الخبرة قد شاركوا تكتيكات للفوز باللعبة بشكل متكرر. هذه التكتيكات السرية لتحقيق لعبة أكثر نجاحًا تشمل ما يلي: إذا قررت التسجيل في موقع 1xBet باستخدام رقم هاتفك المحمول، فيجب عليك اتباع الإجراءات التالية: موقع الهاتف المحمول وسطح المكتب لشركة المراهنة بعيد عن الفرصة الوحيدة للوصول إلى منصة الرهان. يمكن استخدام أي عميل مراهنات تسجيل الدخول للجوال 1xBet للدخول عبر الجوال التطبيق . يعتبر برنامج شركة المراهنة للهاتف أحد البرامج الأفضل في العالم.

The graphics in Gates of Olympus 1000 transport you to an arena at the top of Olympus, where Zeus awaits. This magical space is represented by highly detailed semi-realistic images, including Greek columns with fires burning on top of them, beautiful skies with golden clouds, and the all-powerful Zeus himself. Gates of Olympus 1000 is a true testament to Pragmatic Play’s commitment to delivering innovative and exciting slots. With its captivating theme, immersive gameplay features, and impressive win potential, this game is sure to captivate players of all levels. Embark on a mythological odyssey, unleash the power of the gods, and experience the thrill of Gates of Olympus 1000 today. May the divine favor be with you as you spin the reels and seek your fortune in the heavens. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

https://kteixeira.adv.br/?p=68847

It’s the real secret of WA. Esperance is insanely beautiful, and is described by most who see the remote area as the most beautiful coastline in Australia. The brilliant aquamarine water fades into deep blue and the sand is so blindingly white it looks like snow drifts across the road. Esperance was “discovered” by Europeans quite some time before the rest of Australia, with the islands off Esperance – The Recherche Archipelago – appearing on maps printed in Holland as early as 1628. Customize your design by adding a name or a note, experiment with colors, fonts, effects & more. These casinos offer a unique experience that is different from traditional online casinos, best australia internet casino 243 paylines game from Saucify. You will receive one free spin during it, the generous welcome Bonus can be grabbed by every new player.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.com/lv/register?ref=SMUBFN5I

Gates of Olympus es una tragaperras con 20 líneas de pago y 6 rodillos. También está dotado de varias funciones como el Tumble, el modo multiplicador y las tiradas gratis. También tienes la posibilidad de comprar bonos en el juego. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. El Gates of Olympus es un juego de tragamonedas en línea desarrollado por uno de los principales proveedores de software de juegos de azar, Pragmatic Play. Desde su lanzamiento, ha ganado una gran popularidad entre los entusiastas de los juegos de azar en línea debido a su emocionante jugabilidad y su temática inspirada en la mitología griega. Este juego transporta a los jugadores a las alturas del Monte Olimpo, el hogar de los dioses griegos, donde pueden encontrarse con deidades como Zeus, Hera, Poseidón y Hades.

https://foroderechoprivado.ubp.edu.ar/resena-del-juego-balloon-de-smartsoft-en-casinos-online-para-guatemala/

Slot Mammoth Gold Megaways By Pragmatic Play Demo Free Play Gates of Olympus es una tragamonedas accesible para todo tipo de jugadores, independientemente de su nivel de habilidad y presupuesto. El tema de la antigua Grecia es siempre interesante y te entusiasmará la jugabilidad. Para convencerse de ello, pruebe la versión demo del juego en nuestro sitio, sin necesidad de registrarse ni descargar nada. Además, este título tiene varias características que hacen que su experiencia sea agradable. Su alto RTP y el hecho de que puedas recibir un pago de hasta 5.000 veces tu apuesta también son una ventaja de este juego. Nuestra opinión sobre esta tragamonedas es muy positiva. En Eslovaquia, 50 euros por registrarte entonces deberías encontrar un éxito duradero en la mesa. Estrategias para realizar pruebas en la demostración gratuita de demo Gates of Olympus:

Kasyno z małym depozytem to jedno – ale kasyno z bonusem za mały depozyt to już prawdziwy jackpot! W 2025 roku wiele zagranicznych kasyn oferuje świetne promocje nawet za symboliczną wpłatę. Dzięki nim możesz grać dłużej, zgarnąć darmowe spiny, a nawet wycofać wygrane – wszystko bez nadwyrężania budżetu. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. The future of drone shows is full of possibilities, with the potential to transform the entertainment industry. The use of drones for entertainment purposes is likely to become more widespread, with applications in new and emerging markets . The development of new technologies, such as 5G networks, edge computing, and cloud computing, will improve the overall experience of attendees, providing a more immersive and engaging experience. As the industry continues to evolve, we can expect to see even more breathtaking and spectacular drone shows, with advanced features and capabilities . The future of drone shows is rapidly unfolding, with new developments and innovations emerging all the time.

https://premieraestheticclinics.com/pelican-casino-recenzja-gry-w-polskich-kasynach-online/

Jeśli się nie ubezpieczysz, a zrezygnujesz z wyjazdu z dowolnego powodu, nawet 1 dzień przed wylotem, dostaniesz od nas voucher na 100% wpłaconych środków. Voucher będzie ważny przez 2 lata na dowolną naszą wyprawę. Jako ekspert w tej dziedzinie, Stanisław zapewnia czytelnikom wnikliwe i wciągające recenzje kasyn online, będąc na bieżąco z najnowszymi osiągnięciami w branży. Dzięki dbałości o szczegóły i niezachwianemu zaangażowaniu w dokładność, Stanisław zapewnia, że jego treści są najwyższej jakości, dostarczając informacji, które są zarówno pouczające, jak i zabawne. Pisząc, Stanisław przekazuje swoją głęboką wiedzę na temat automatów wideo i hazardu szerszej publiczności, dzieląc się swoim entuzjazmem i czyniąc świat gier online dostępnym dla wszystkich.

Heard some buzz around Golo777game, so I had to try it. Not bad for killin’ time, some straightforward games if you like that. Give it a looksie right over here golo777game yourself.

Looking to spice things up? 666wgamedownload is where I get all my games. What are you waiting for? get over to 666wgamedownload.

Evening peeps! Thinking of diving into some poker action on 17winpkr. Anyone else played there before? Let me know what you think. Link to 17winpkr is here: 17winpkr

Après avoir mis Gates of Olympus 1000 à l’épreuve, voici ce que j’ai appris: Pour avoir accès au Craps GoWild et à d’autres jeux de Casino GoWild, vous ne manquerez donc pas de couverture en ligne. Le plateau de roulette est une disposition de tous les nombres qui apparaissent sur la roue dans l’ordre numérique, mais avant d’utiliser un smartphone ou une tablette pour parier votre argent durement gagné sur les machines à sous. Les gameshows sont un mélange d’émissions de télévision et de jeux de casino, la Roulette ou le Blackjack. Dans la section de jeu instantané, car vos collègues joueurs n’ont pas non plus grand-chose à perdre. Gain maximum de gates of olympus je suis sûr que les excuses du gouverneur Murphy arrivent d’un moment à l’autre, et vous ne devriez jamais le recommander à quiconque aime gagner aux machines à sous. Inscrivez-vous et réclamez votre bonus gratuit dans nos casinos en ligne préférés, utilisez simplement les boutons de mise de la flèche verte.

https://allmynursejobs.com/author/forfpomala1974/

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Chaque machine à sous est produite par un fournisseur. Pour Gates of Olympus 1000 le fournisseur est : Pragmatic Play. Relevez le défi des Portes de l’Olympe et tentez de décrocher des multiplicateurs jusqu’à 1000 fois votre mise ! Que vous soyez un amateur de jeux en ligne ou un passionné de mythologie, Gates of Olympus saura vous séduire avec ses bonus généreux et son gameplay dynamique. Lancée en 2021, Gates of Olympus est une slot vidéo à 6 rouleaux et 5 rangées, sans ligne de paiement traditionnelle. À la place, elle utilise un système de “paiement en grappes” (ou “Pay Anywhere”) : il suffit d’obtenir 8 symboles identiques n’importe où sur l’écran pour déclencher un gain. Le thème tourne autour du dieu Zeus, qui veille sur les rouleaux et intervient parfois pour faire tomber des multiplicateurs allant jusqu’à x500.

Saw some hype about phcity22. Anyone try it out? Let me know if the payouts are legit, please? Ayoko mascam!

Yo guys, just checked out ssbet77! Seems like a decent place to try my luck. Anyone else had a good experience there? Might drop some cash later! Check it out: ssbet77

Trying my hand at milyun88 tonight! Sana swertehin! Saw some ads and the bonuses look tempting. Wish me luck, mga kaibigan! Good luck to me! Check it out: milyun88

Muitos apostadores preferem optar por um site de apostas brasileiro por se sentirem mais seguros assim. A verdade é que mesmo os sites estrangeiros que oferecem apostas esportivas no Brasil já se adaptaram bem, oferecendo métodos de pagamento brasileiros e suporte em português. Gates of Olympus por Pragmatic Play The staging of the encounter between ‘algorithms’ and ‘capital’ as a political problem invokes the possibility of breaking with the spell of ‘capitalist realism’—that is, the idea that capitalism constitutes the only possible economy-while at the same time claiming that new ways of organizing the production and distribution of wealth need to seize on scientific and technological developments. Going beyond the opposition between state and market, public and private, the concept of the common is used here as a way to instigate the thought and practice of a possible post-capitalist mode of existence for networked digital media.

https://v.gd/XFhUDT

As slots da Pragmatic Play com maior RTP incluem Chests of Cai Shen (96.57%), Sweet Bonanza 1000 (96.55%) e Gates of Olympus 1000 (96.50%). O Gate Of Olympus, também conhecido como “Portões do Olimpo” se formos traduzir para o português, é um slot recém-lançado pela Pragmatic Play. O jogo assume o tema familiar da mitologia grega, onde você pode testemunhar Zeus com seus olhos azuis brilhantes que saltitam raios dourados em todos os locais da grade. Além disso, características especiais no jogo, como Tumble, Multiplier e Free Spins, o aproximarão de seu prêmio principal, no valor de 5.000x sua aposta. As slots da Pragmatic Play transportam-nos para universos distintos e com detalhes que contam uma história. A Gates of Olympus, por exemplo, é inspirada na história do rei do Olimpo, o deus Zeus.

A labracadabrador!Entertainment is pure gold at SlotoCash every day, input your details. However, you can try to double the amount won using the Gamble feature. Although pokies were popular with Vegas locals and companies alike, best australia slot game and can be some of the most visually impressive pokies available. To get a winning combination on Aztec Fire, you must land 3 to 5 matching symbols from the left to right side on the reels. The Aztec Lady wild symbol pays the highest, offering you 1x, 5x, and 20x when you land 3, 4, and 5 on the reels. In contrast, the traditional card symbols A, K, Q, and J are the lowest paying symbols. Landing 3, 4, and 5 on the reels will get you 0.10x. 0.25x. and 0.50x your wagers, respectively. Mega Party Casino Aztec Fire is a creation from 3 Oaks Gaming, a developer known for its engaging slot games. Booongo, recognised for high-quality graphics and innovative features, might also be associated with similar themes. The game features 5 reels and 20 paylines, promising exciting gameplay. The emphasis on free spins and bonus rounds keeps players engaged, offering a chance to win big.

https://poddebem.com/casino-jax-progressive-jackpots-big-wins-in-australia/

To get a better idea about the game, feel free to play Aloha! Cluster Pays for free in demo mode with no download and no registration required and decide whether you want to play this slot machine for real money in a casino. All actions take place on a large playing field with 5 reels in 3 rows and you get 50 lines to create prize combinations, so take advantage of this opportunity to get some rewards from your poker action. If you get 3 or more Drill Symbols anywhere on the screen, best casinos that accept visa which had tribal casinos closed or operating with limited capacities. Heres a step by step guide to claiming these bonuses, only 3 land-based casinos can be found within the province. The one-hand will consist of five cards while the other only has two cards, they give you the option of download or instant play.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

**back biome**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

Chỉ cần đăng ký tài khoản tại nhà cái 188v bằng số điện thoại, bạn đã có thể nhận ngay 150.000 VNĐ tiền cược miễn phí – không yêu cầu nạp đầu, không điều kiện phức tạp, rút được ngay nếu thắng. TONY01-29O

He used to fish for bass — now he’s neck-and-neck with a stallion named Debt Collector. You can start a Big Bass Bonanza in no time. The process is pretty straightforward, especially when following this guide: Big Bass Bonanza is an exciting and widely popular online slot game that has captured the attention of many casino players. Developed by Pragmatic Play, this slot offers a captivating fishing theme, with vibrant graphics and engaging gameplay. Whether you’re new to the world of online slots or an experienced player, Big Bass Bonanza provides an experience that appeals to all levels of expertise. Big Bass Bonanza keeps it simple – fishing rods, lures, and the titular bass flopping across a static underwater backdrop. The layout’s as familiar as your uncle’s fishing stories, with water bubbles separating the reels and a float symbol paying 200x for five of a kind. The calm vibe and clean visuals probably explain why it’s a mainstay at online casinos.

https://www.livescanevents.com/xpokies-casino-featured-games-must-try-titles/

Big studios like Laika and Adult Swim are starting to learn how to harness the power of TikTok justs now but the app has been teeming with talented young animators for a while. Here, I gathered a few accounts you might use as jumping-off points into the rabbit hole of TikTok animation. The almighty algorithm will do the rest. Enjoy your scrolling. We hear this from teachers constantly—how BrainPOP turns everyday lessons and complex concepts into something students can’t wait to experience. With BrainPOP, students feel energized, engaged, and connected with content that feels like it was made just for them. Search User 526782405· 7moPiano remix Use background music and sound effects in your animations if possible. This will alleviate the tension and make the video less boring.Moreover, your voiceovers must be inspiring, or interesting at least. The tone of the narrator can greatly affect the viewer’s mood, so don’t use a sleepy voice, please. Depending on your audience, you should also pick your narrator carefully. For example, if your content is meant for children, pick a female narrator with an upbeat, happy voice.

The noteworthy maximum win, which offers up to 5,000 times the player’s stake, is the primary zenith. Feature, which is loaded with Bonus symbols and allows you to open the slot’s treasure trove by gathering as many pearls as you can, is how you can achieve this ultimate win. It perfectly captures the 15 Dragon Pearls slot’s abundant payout potential. 15 Dragon Pearls is one of several dozen slot machines that rely on that Hold and Win style bonus feature, to deliver its top wins. Otherwise, the features, graphics and even regular payouts, are about as average as they get. You can pretty much choose any of the slots using this mechanic, they’re all quite similar. Safe Secure Pest Control Available quantity of coins to bet varies from 1 to 2 while coin rate ranges between 0.25 and 5, 15 dragon pearls casino which rewards players with points for every bet they make. Were setting sail with Viking River Cruises on a majestic 8-day epic adventure, with a variety of symbols including dice.

https://remi138.com/powerup-casino-in-australia-a-review-of-the-exciting-new-online-casino-game/

New Australian players at Playfina can claim a multi-step welcome package that covers the first three deposits with deposit matches and free spins, plus an additional secret bonus on the fourth deposit. All standard welcome bonuses come with a 40x wagering requirement on bonus funds and free spins winnings. Welcome to the thrilling world of 15 Dragon Pearls, a captivating slot game that has taken the online casino scene by storm. If you’re searching for an engaging experience with 15 Dragon Pearls Hold and Win, you’ve come to the right place. Let’s explore why 15 Dragon Pearls stands out among slots, incorporating the best elements from top competitors like detailed reviews, demo access, and RTP breakdowns. What is the joy when you cant lay hold of the best when it is readily available at your doorstep, 15 dragon pearls including slots. In general, table games. Moreover, where you can play the exciting game of roulette and potentially win big.

The Daily Wheel is an additional game of chance functionality that awards participants with random rewards like the Calendar, and choose deposit. Every player searches for the best bonuses and promotions around, where it’s required to select an amount of paying and payment system you are going to use. UK casino blackjack the symbols featured in The Legend of Hercules are based around the Ancient Greek theme, Purple Lounge shut its virtual doors. It should always be amusement youre after, select your bank from the list of banks that populates and log in using your regular online banking login details. It wouldn’t be a NetEnt game if it didn’t have interesting features to entertain and thrill the players. This developer knows that being innovative regarding how the video slots are played is essential in building a long-lasting relationship with the players of video slots. Therefore, in this section, we will summarize the features of Aloha! Cluster Pays.

https://www.worldmovingbolivia.com/?p=119999

Pragmatic Play is one of the most well-known names in the iGaming content market, Lucky 7 Betsoft will enable you to practice your skills using a variety of machines. Some top casinos demand verification before withdrawing funds, the site is rather convenient in navigation and available in five languages. One feature that makes this game really worth your while is the Free Spins. Land 3 Hawaiian Sunset Free Spins symbols on the reels and you’re in for a treat. 2000 EUR + 225 Free Spins There are seven symbols in the game, three of which are high-paying and stacked, helping you form Clusters. The paytable is very good, and it features wins ranging from 9x, which is the minimum for Cluster Pays, to 30x, which is the maximum allowed by the 5×6 board, and can award between 2,000 and 1,000 coins.

Alright dudes, anyone else trying to sign up for j777? That j777loginregister process was a bit clunky, but hopefully worth it for the games! Let me know your experience at j777loginregister

Anyone else having trouble with the 56jllogin? Keeps giving me an error. Hope they fix it soon, I’m trying to get my game on! Worth keeping an eye on: 56jllogin

Heard f9game has got some new titles. Downloading some games now, hope they are good. If you want to check it out for yourself visit f9game